We’ve all witnessed the level of consumer detriment caused by payday lending. The recession has most definitely driven more and more consumers towards this form of borrowing since credit from the banks dried up, even though the APR on these can be as much as 4,000%. The biggest problem with payday loans is that the majority of borrowers do not use them as they are intended, and this causes the snowball effect. They go back for more, time and time again and rolling over becomes a habit – an expensive one!

With the OFT publishing their report on Payday Lending in March, I can’t say I was surprised to see their findings. I’m sure we’ve all mulled over it, tutting and shaking our heads disapprovingly so I’ll quickly re-cap their findings;-

- Around one third of loans are repaid late or not repaid at all.

- 28% of loans are rolled over at least once which provides 50% of the payday lenders revenue.

- 19% of revenue comes from just 5% of loans which are rolled over 4 or more times.

- Debt Advisers reported that borrows seeking help with payday lending debts had on average rolled over at least 4 times and had 6 payday loans.

- 30 of the 50 websites looked at emphasised speed and simplicity over cost – in some cases, making claims that, if true, would amount to irresponsible lending.

- 38 of the 50 lenders inspected failed to comply with at least one of the complaint handling rules of the Financial Ombudsman Service.

Back in July 2011 when the CFA introduced the Payday Loan code of practice, it was the general belief that this guidance would result in the Payday lenders taking steps to construct good practice, which if adopted ‘all round’, would result in everyone singing from the same hymn sheet & the more boisterous among them toning down their ominous tactics when collection of the debt becomes debt collection!

Payday lenders have been accused of preying on people who are desperate for cash and this desperation means they skip over the small print, neglect to read the ‘should you fail to pay’ disclosure and the huge interest rates that quickly rack up after failing to pay.

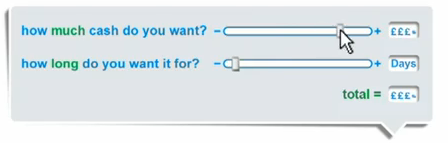

Wonga seems to be the most popular one and Betty, Earl and Joyce, the disturbing puppet pensioners are back in Wonga HQ in their most recent advert, explaining how to chose a short term cash loan using their sliders.

The consumers taking out this type of loan seem to fall into 2 categories and it’s the latter ones who we see days in day out. There is the “Wonga Weekenders” who take out a cheeky £75 loan the weekend before payday and repay it, no harm in that. Then there are those who live month to month, repaying one to take out another, gaining access to larger and larger loans as they become valued, loyal customers. This is when they start rolling over – these are the snowballers. These are the people who eventually end up needing some form of debt management or if they have been juggling these controversial loans for months if not years, debt relief.

Research undertaken by Consumer Focus has indicated that the profile of the UK payday loan borrower is young adults under the age of 35, single and without children. Suprising!

“Fast Cash for Fast Lives” INDEED Kerry Katona!

Many consumers are in a weak bargaining position, and firms compete on speed of approval rather than on price. This shows that these people are desperate and need cash there and then.

More and more debtors are approaching IP’s for advice on how to deal with this never ending spiral of debt, it’s usually not that they can’t afford to repay it, they just need time and a bit of breathing space to do so. Like a client who heard Don’t Fret About Debt.NET on the radio.

He approached me with £7,500 of payday loan debts owed to 11 different companies. He earned a good wage and wouldn’t normally require this kind of cash advance. He simply needed some money to pay for car repairs and took out a payday loan which he intended to repay on his next payday – which he did. By the middle of the next month he had ran out of money due to repaying the loan in full.

In July 2011 when the Payday Loan code of practice was introduced by the Consumer Finance Association I wrote an article aimed at debtors, an excertion is below which explains what happened to my client.

“If you cant see a way of ever getting out of ‘rolling over’ don’t think that it’s as easy as cancelling your direct debit and waiting for the debt collection letter to pass through your door.

I’m sure you’ve heard it before however for those who haven’t, READ THE SMALL PRINT. Your credit agreement will probably state, very unclearly that should you fail to maintain your agreement or pay the balance when they say, your basically allowing them to;-

Call you at your home, at work and on your mobile, on the hour every hour and perhaps crack open the yellow pages and call everyone with your surname asking “does Dave live there?”

Leave messages with your colleagues that your debt is overdue and you must contact them or you’ll die

Sent you various e-mails/letters headed up ‘ Pre Litigation’ or Court Action pending’

So, what do the OTF propose to do about it?

- Formal investigations against a number of payday loan firms and more enforcement action in the pipeline.

- Requirement of 50 lenders – accounting for 90% of the market, to take immediate steps to address areas of non-compliance and prove they have done so within 12 weeks – lenders failing to cooperate will risk losing their licence.

- They have issued clear statements about how the OTF guidance applied to payday lenders and written to every payday lender making it clear that they expect them to act now to ensure these standards are met.

- They have provisionally decided to refer to payday lending market to the Competition Commission for a full investigation.

Continue to monitor the market and to work with partners such as the debt advice sector to gather evidence which supports their investigations.

With any luck, now payday lenders realise the scrutiny they are up against and that they need to start playing nice or risk loosing their licence. This coupled with the OFT’s principles for businesses using CPA’s which was issued on 12 December last year should ensure that there are less burnt fingers out there. Now they must provide clear and prominent information on how to cancel a CPA.

Historically a debtor’s bank or card provider has stated they are unable to prevent the payments going through which leaves many debtor’s experiencing financial hardship and potentially means they are repaying their payday loan instead of priority debts.

Now this guidance has been issued, it is simply a matter of contacting the bank and telling them to make no further payments. If someone does come to you for advice regarding Payday Loan debt then this is the first thing they must do or the payday lender may just please themselves and bleed their bank account dry.

Payday lenders will escape a cap on exorbitant interest rates, but will face unlimited fines for breaking the new rules. Is it enough?

| About Nicola - Nicola is a Personal Insolvency Manager with Campbell Dallas Debt Solutions. Follow them on Twitter @CDDebtSolutions